It Ain’t Chicken Feed Anymore

The many factors driving high feed costs

It’s not news to chicken owners, but feed costs are way up. Nutritionists and poultry people of all kinds have had to deal with skyrocketing raw material costs which impact the cost of feed.

A perfect storm of events has driven food and feed costs to unprecedented levels.

In this article we’ll cover some of the many causes and see if there is any light at the end of the tunnel.

What hit the fan? Everything

The initial March 2020 pread of COVID in the U.S. led to lockdowns, closures, and disruption of the global supply chain. Less than 6 months later, the August 2020 Midwest Derecho tore through Iowa, Nebraska, Illinois, Wisconsin, and other Midwest states. The storm dropped national corn supply estimates by more than 600 million bushels and soybean estimates by more than 200 million bushels.

Coupled with high export demand, these events pushed commodity prices up in a fashion that we had only seen once or twice in the past 25 years.

Then, in 2021, feed ingredient prices reached their highest levels in a decade, driven by drought conditions in the upper Midwest, massive Chinese imports, and a return of volatility in the grain markets not seen in many years.

China’s imports were a result of the 2018-2019 outbreak of African Swine Flu which led to as many as 300 million pigs dead or culled (about 25% of the global hog population).

The Chinese government made it a priority to restore their hog inventory, which led to a 289% increase in corn imports over the previous year.

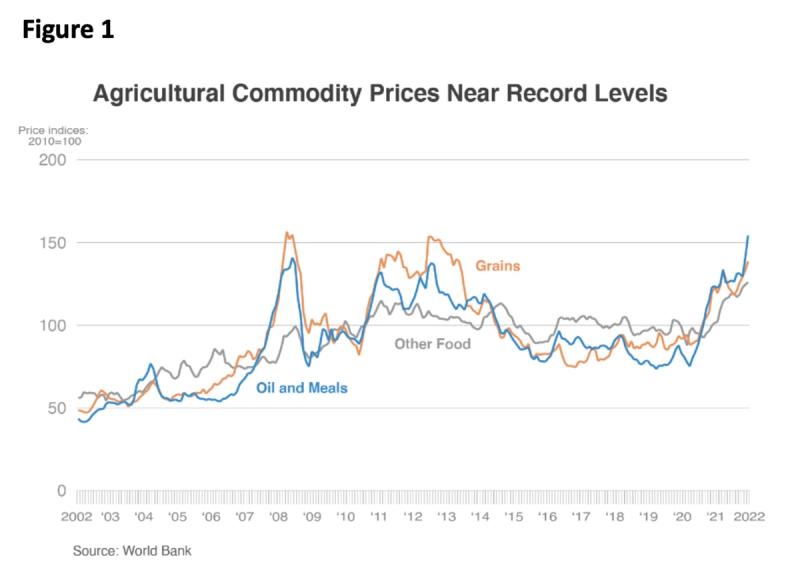

The result? In 2022, we’ve taken a multitude of punches and seen commodity prices reach historic levels (Figure 1).

The impact of the COVID-19 pandemic on our daily lives has mostly subsided, but the disruption of the global supply chain and labor force shortages continue to affect ingredient prices.

‘I’m from the government…’

On top of the lingering effects of the pandemic, a $1.9 trillion economic stimulus bill called the “American Rescue Plan Act of 2021” was implemented —although much of the U.S. economy had already largely recovered from the pandemic.

The unemployment rate had fallen from a high of 14.7% in April 2020 down to 6% (vs. the Pre-COVID rate of 3.5%).

In addition to a $3 trillion bi-partisan economic relief package in 2020, the combined budget stimulus would contribute to the current inflation environment.

The post-pandemic economic recovery also led to a higher demand for raw materials due to increased global demand for animal protein. Coupled with lingering labor and international shipping issues, this also drove prices upward this year.

Supply-and-demand wasn’t the only other factor related to post-COVID recovery influencing commodity prices, however. Wage increases were seen across the board and passed on to consumers via price increases. JBS Foods, the majority owner of Pilgrim’s Pride, the Number Two commercial broiler company in the U.S., reported operating costs increased by 30 to 40%, driven by commodity prices and labor cost increases.

It’s the GLOBAL economy

Then, geopolitical factors came into play and wreaked more havoc: In February 2022, Russia implemented a full-scale invasion of Ukraine.

In addition to tens of thousands of deaths and the displacement of more than 8 million people, the conflict put global markets into turmoil. Russia and Ukraine are often referred to as the breadbasket of Europe, accounting for nearly 30% of global wheat exports and more than 75% of global sunflower oil exports.

Russia is also a major source of fertilizer raw ingredients such as potash, phosphorus, and nitrogen and a global fertilizer exporter.

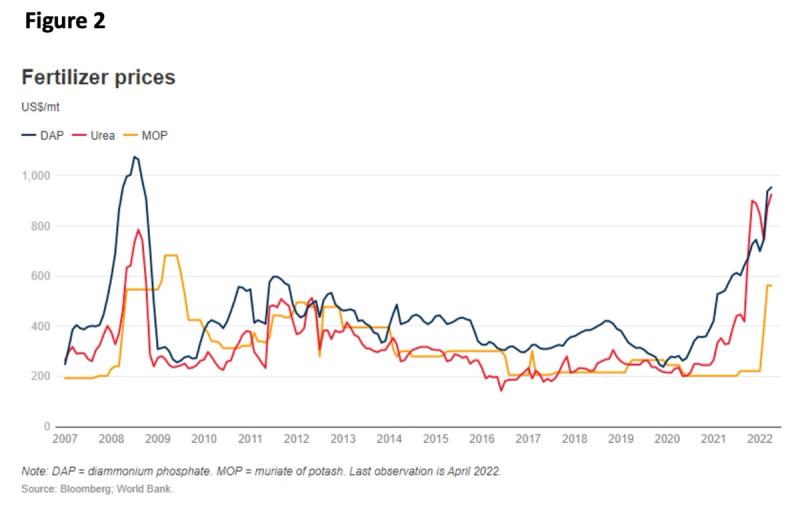

The invasion immediately led to fertilizer prices not seen since 2008 due to sanctions and supply chain disruptions.

In addition to accounting for nearly 20% of global urea and MOP (muriate of potash) exports, Russia is also a major source of fertilizer raw materials, such as ammonia and sulfur. Of course, fertilizer costs affect the prices of nearly all major feed ingredients and the war led to a surge in cost right as we headed into corn planting season this year (Figure 2).

You have to move it, move it, move it

Finally, transportation has had a tremendous effect on feed prices, and will continue to be a major factor in years to come. The American Trucking Association reported a nationwide shortage of 80,000 truck drivers, expected to reach 160,000 by 2030.

The average age of a commercial truck driver (48) is much higher than the average age of U.S. workers overall. The pool of young drivers entering the industry is simply not large enough to replace the number of retiring drivers.

While major ingredients like corn, soybeans, and wheat are grown in the United States, many micro-ingredients like vitamins, amino acids, and phytogenic feed additives are produced exclusively in other countries.

Port congestion has caused prices to increase, sometimes having dozens of ships waiting just offshore and ships remaining at port for 7 days on average—21% higher than at the start of the pandemic. As a result, ocean freight costs have risen to around 7 times pre-pandemic levels.

Keep your fingers crossed

So, is there any good news? Yes, thank goodness!

Morgan Stanley believes that increased agricultural output, weather normalization, and potential easing of tensions between Russia and Ukraine could bring prices back down in 2023.

Also, the Safe Driver Apprenticeship Pilot Program established in the Bipartisan Infrastructure Law, allows 18- to 20-year-old drivers to begin training with an older experienced driver and eventually earn the right to operate a commercial vehicle unsupervised. This could lead to more drivers and decreased freight charges in the future (or at least pump the brakes on logistical challenges).

Ingredient and feed prices are unlikely to go back to pre-2020 levels, but I do think they will come down from where they are now—assuming we won’t see this number of contributing factors all at the same time again anytime soon.

But rest assured, there are better days ahead!

Tags:Feed 4 Thought

Chicken Whisperer is part of the Catalyst Communications Network publication family.